In this scenario, your spouse’s obligations might diminish or delay your joint tax refund. Fortunately, if you can prove you were unaware of the misinformation, you won’t suffer legal consequences.įurthermore, your spouse might have a court-ordered garnishment for debt or child support. As a result, you might experience legal ramifications if your spouse misreports or lies about numbers on the tax return. For example, by signing a joint return, you become liable for its contents, even if your spouse prepared it alone. Drawbacks to Filing Jointlyįiling jointly has its pitfalls as well. In addition, filing jointly will likely require less time than filing twice. Less Expensive Tax Filingsįiling taxes can cost hundreds of dollars, so paying for one tax return instead of two significantly decreases expenses. Plus, filing with a spouse allows you to carry over leftover contributions to the next year if one spouse’s income isn’t double the amount of their charitable giving for the year.

However, those who file jointly combine their income to determine this limit. In addition, taxpayers usually can only deduct charitable contributions of up to 50% of their annual income. Plus, filing jointly can lower your combined income enough to access tax credits such as the Child and Dependent Care Tax Credit and the American Opportunity Tax Credit. Instead, they receive double the amount for single filers, or $25,900, for 2022. Married couples filing jointly don’t lose by taking the standard deduction. When a taxpayer files single or married filing separately, the standard deduction is $12,9. Increased Standard Deductions and Credits As a result, married couples can preserve their wealth if one of them dies. If one member of the couple passes away, they can transfer their entire estate – all their wealth and assets – to their spouse without incurring a nickel of estate taxes. For instance, the other member of the marriage generating income can use their spouse’s losses as a tax deduction while also claiming deductions for mortgage interest payments, medical expenses and state and local taxes (SALT). However, they can create a tax advantage for the couple. Tax Shelter OpportunityĪ spouse with a business that isn’t producing income wouldn’t be able to claim most deductions if they filed taxes separately. In 2023, the MAGI limit will increase to $218,000.

#Tax brackets 2022 married full

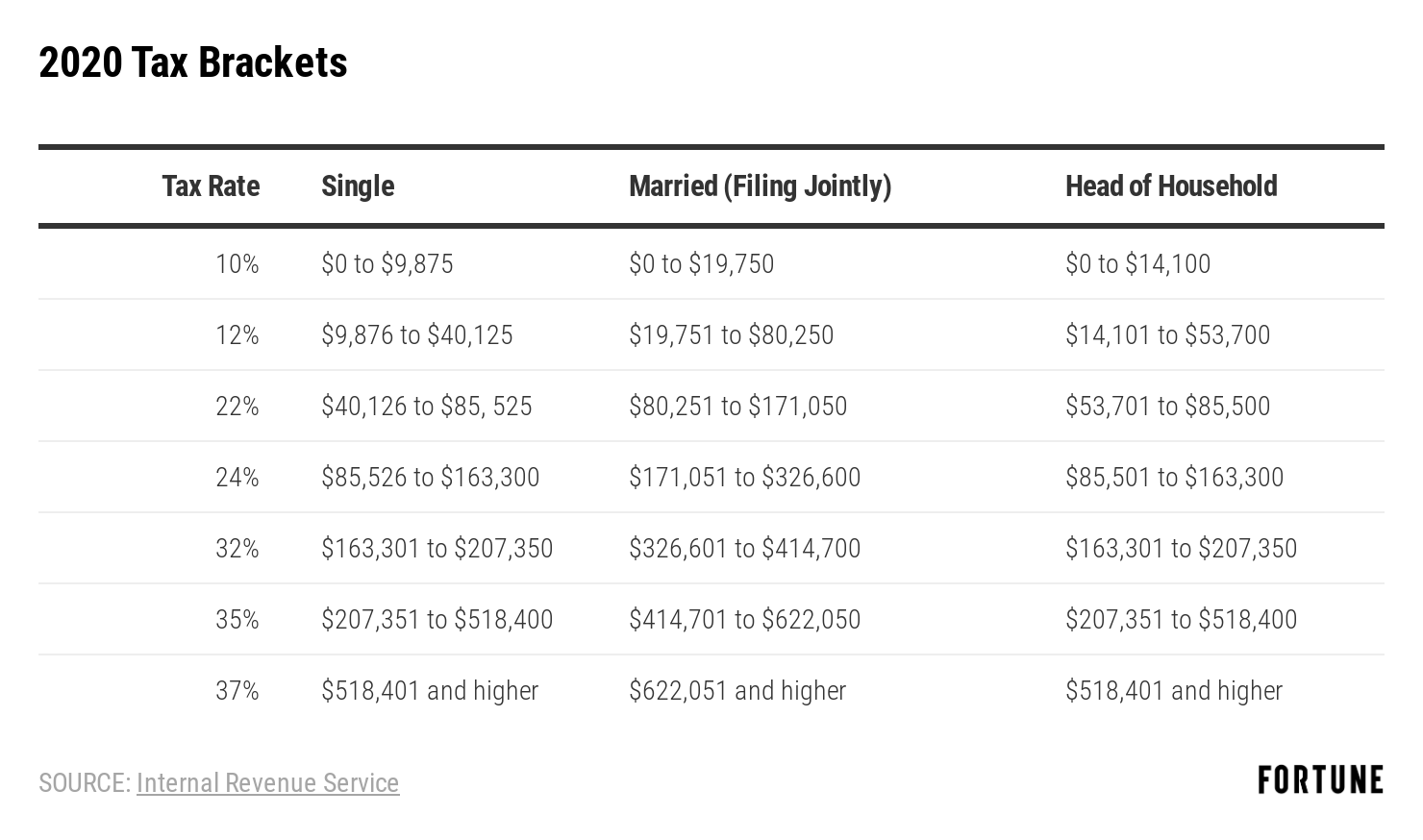

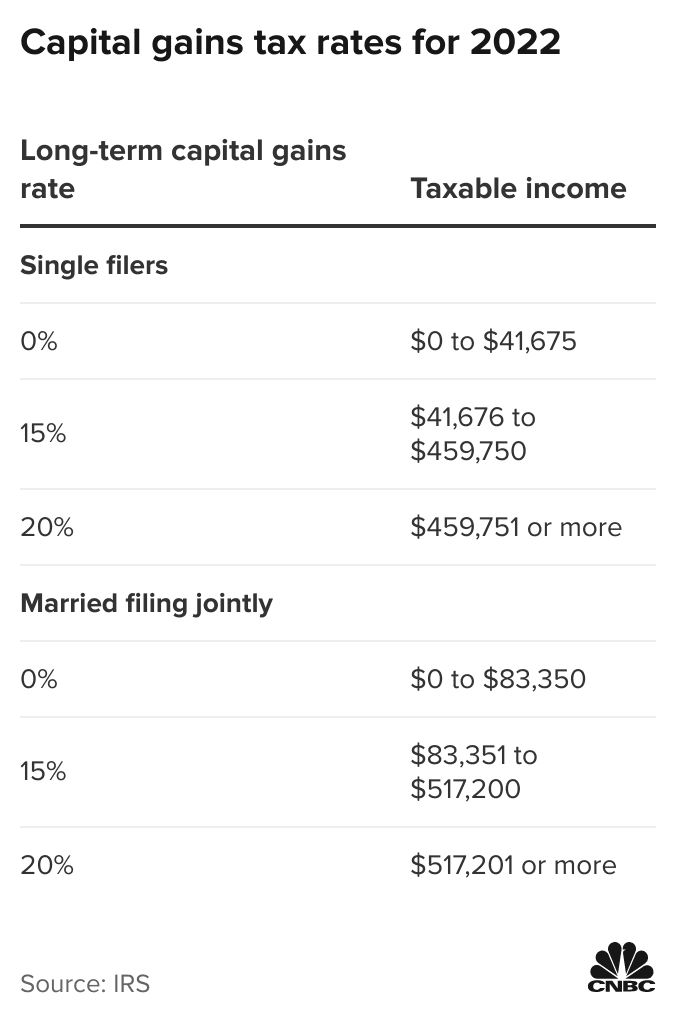

Specifically, couples with a modified adjusted gross income (MAGI) of $204,000 or less in 2022 can make a full contribution to their accounts. A spouse who has a retirement plan at work might lower the deductible amount from taxes – but the fact remains that the couple can each have IRAs.įurthermore, couples filing jointly have a higher income limit for Roth IRA eligibility. Fortunately, if a taxpayer who doesn’t earn wages is married, they can use their spouse’s income to fund their own IRA.įor example, if both spouses contribute to their own traditional IRAs, they would lower their taxable income by thousands of dollars. See more details in the table below to see how filing jointly can lower taxation on higher amounts of income: 2022 Federal Income Tax Bracketsįederal law typically prevents single taxpayers who don’t earn wages from contributing to an individual retirement account (IRA). Your top tax bracket would be 22% because of how tax law places couples filing jointly. You make $120,000 and your spouse makes $40,000 this year. On the other hand, say you are married and filing jointly. However, if you’re married and filing jointly, the tax brackets may work in your favor.įor example, if you make $120,000 this year and file single, part of your income would land in the 24% tax bracket for 2022.

Your income puts you into a specific tax bracket, meaning the government taxes your income at higher rates when you make more. Remember, the benefits below don’t apply to couples filing separately, which we cover in more detail below.

While it isn’t wise to marry for financial reasons, tying the knot allows couples to enjoy the following tax benefits when filing jointly.

0 kommentar(er)

0 kommentar(er)